In this episode of Impact Talks, we had the pleasure of speaking with Dr. Lidia Aviles, a globally recognized expert in sustainability, innovation, and strategic partnerships. As an EU Climate Pact Ambassador since 2021 and a Top Global Advisor at IAOTP, Lidia is at the forefront of global efforts to drive sustainability and technological advancement.

She is the Founder and CEO of Aelstone, which focuses on SDG 17: Partnerships for the Goals. She is also a partner at SIGF a fund that focuses on key sectors such as Infratech, taking an active approach by supporting managers with commercial development and public affairs expertise to drive growth while aiming for an exit within approximately five years. The firm maintains a robust portfolio that reflects its commitment to these dynamic industries. Backed by a highly experienced team, SIGF leverages deep industry insights, strong market acumen, and a proven track record. Internally, the firm upholds a KPI of delivering DPI on every asset.

Beyond her leadership roles, Lidia is an accomplished author. She has written AI for Sustainability and co-authored AI for Economy, which examines the role of AI in shaping a more sustainable future. With a background in aviation, energy storage, and digitalization, she has played a key role in advancing sustainable innovations.

In our conversation, we dive deep into AI’s evolving role in sustainability and finance, the future of hybrid intelligence, and how impact-driven investments are shaping industries.

Join us as we explore how AI, sustainability, and private markets are converging to create meaningful change.

But before we dive in, I’d love to know more about you.

Lidia and I met in Amsterdam last year, and since then, well, I don’t know—we’ve followed each other. Actually, I follow her! We connected, and she’s been very busy.

Can you tell us a little bit about your personal journey? You’re currently based in Belgium, but I’m not sure if you were born and raised there, because you speak Spanish perfectly. Tell us a bit about that and how you ended up becoming an AI expert, involved in venture capital and sustainability.

Thank you, Laura! Yes, we met in Amsterdam quite recently, but I think we had a great conversation that lasted for hours. And I wouldn’t say you just follow me—I think we connected because we share an interest in this space, right? So, I’m really grateful for this opportunity.

You mentioned a lot of different things, so let’s break them down.

Were you born and raised in Belgium?

No, I was born in El Salvador. At the time, the country was famous for the wrong reasons, but now the image has changed with the new government and other developments.

I actually visited recently—for the first time in many years—and it was the first time I truly enjoyed the country, which was quite a special experience.

How long has it been since your last trip?

I used to visit every two or three years, but I never lived there. I left when I was four and grew up in different countries—Nicaragua, Massachusetts, Florida.I never really felt connected to El Salvador, and I never enjoyed my visits until recently, so this trip was a unique experience.

My father was a reverend, and his mission was in Nicaragua, so I grew up there. Later, my mother and I moved to Massachusetts, where I spent my teenage years and finished high school.

I moved to Belgium 15 years ago, which is ironic because it’s now the country I’ve lived in the longest. And so, I became Belgian.

So, you moved to Belgium and built your professional career there, right?

Yes, I moved when I was quite young. But my journey into AI and innovation actually started in Massachusetts. When I was in high school, everyone was talking about coding—kind of like how everyone talks about AI today. It was a big deal—people would gather in cafes in Boston just to discuss coding.

Did you feel ahead of the curve when you moved to Belgium?

Yes, absolutely. I noticed that I connected more with younger generations because they were more engaged in technology. People in my age group, at least in this region, weren’t as deeply involved in tech innovation. So, that was a bit of a cultural shift for me.

And how did you get into venture capital?

About six or seven years ago, I was working in the aviation industry, and suddenly, I started getting contacted by investment bankers from different regions. At the time, I didn’t fully understand why they were reaching out. I was younger, more focused on corporate and business development—I wasn’t thinking about venture capital.

So they just started reaching out? What were they asking?

Yes, they wanted my insights on emerging technologies. I wasn’t even aware that my name was coming up in AI discussions. But then I started noticing something strange—I would read institutional reports and books, and the writing felt… off. As a writer, I could tell that some sections were AI-generated because they were repetitive and oddly structured.

That’s when I realized: AI was already here, shaping content and decision-making, long before most people noticed.

That’s fascinating! So you wrote two books: AI for Sustainability and AI for Economy. In terms of investments, AI is a huge buzzword. But what makes a good AI investment?

It depends on your investment strategy and ticket size.

A lot of people have been investing in AI tools, but the real opportunities lie in AI infrastructure—the foundational layers that power AI, like hardware, connectivity, quantum computing, and molecular AI. Investing in AI as a tool is one thing, but investing in AI as a core enabler is where the real potential lies.

Are there any major AI investment opportunities in Europe?

Yes! The European Union has launched Horizon projects focusing on AI development. Some really interesting initiatives are emerging, and I think we’ll see more growth in AI infrastructure here. So, when we talk about AI investments, AI as a tool is a different category.

Are there good AI investment opportunities in Europe?

Yes! We already have some exciting projects happening in Europe. The European Union has launched several initiatives under the Horizon program focused on AI, including applications in transportation and other sectors.

In our investment strategy, we’re also looking at these developments closely because we work with developers, scientists, and innovators who are shaping the future of AI.

But if we go back to the core of the conversation—what makes a good AI investment?—the answer lies in looking ahead into the future.

For example, did you see the recent announcement from OpenAI? Just a day or two ago, they mentioned that ChatGPT will now integrate reminders and task lists. That might seem like a small feature, but if you think about it, many companies were built solely on offering those services. Now, AI is replacing entire business models, not just assisting them.

And this is just one example—think about how AI is already transforming fields like design, accounting, and data analysis.

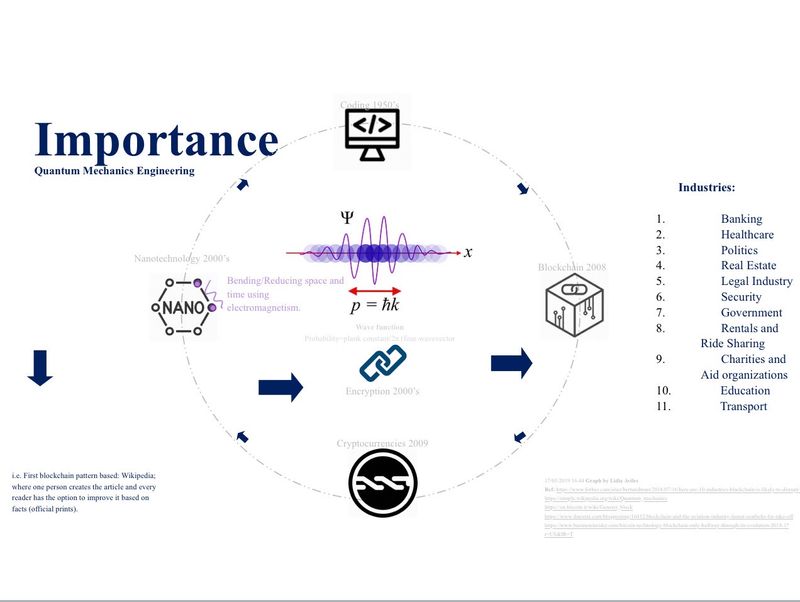

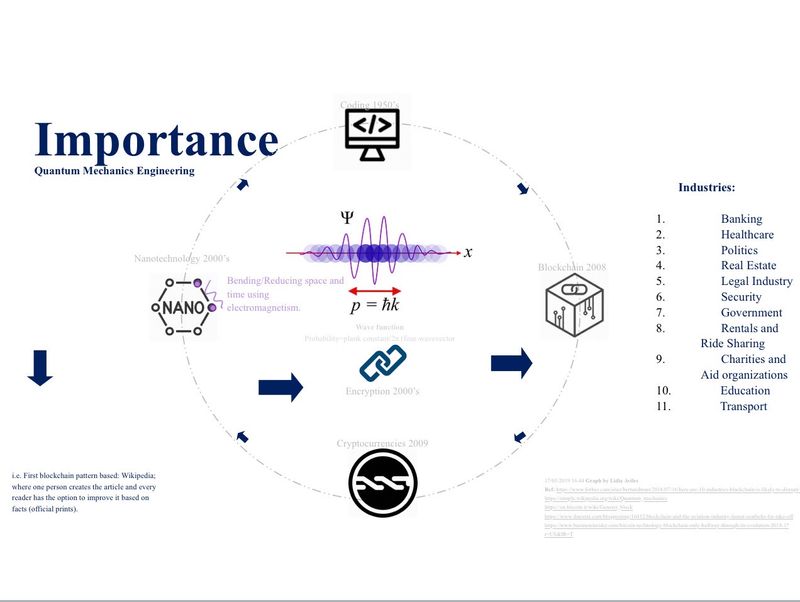

I was recently looking at some research I did back in 2018 or 2019, where I explored how data, connectivity, and blockchain would impact industries. Now, we’re witnessing those predictions coming true—AI is becoming the backbone of every sector.

At some point, every industry will be completely dominated by AI. And when I say "dominated," I don’t mean replacing humans entirely. It’s about how AI integrates into every aspect of business and society.

So what are we doing about that? One key concept emerging is hybrid intelligence—the collaboration between humans and AI.

Hybrid Intelligence: The Next Step in AI Evolution

What exactly is hybrid intelligence? How close are we to achieving it?

We’re already on the edge of it. There are pilot projects underway, particularly in transportation and security, which require both AI and human input.

It’s interesting because, for years, people in social sciences were sidelined in favor of technologists and engineers. Now, we’re seeing a shift back—we actually need experts in psychology, ethics, and human behavior to shape AI responsibly.

Why?

Because AI must be human-centered by design.

A lot of people fear AI, talking about how it could be dangerous. And sure, like any technology, it has risks. But nobody is intentionally designing AI to harm humanity. If something goes wrong, it’s likely an accident, not a deliberate act.

At the end of the day, hybrid intelligence is the goal—a world where AI and humans work together seamlessly. And I believe we’ll be there by 2030.

Investment in AI: How Ready Is the Industry?

Many investment funds claim they "only invest in AI." How prepared is the industry to actually invest in AI beyond just tools?

There are two key issues here:

The expertise gap – We have great AI experts, but not all of them work in investment funds.

Siloed thinking – The investment world often operates in isolation, which slows progress.

One of the biggest problems in the investment sector—as in many industries—is that people work in silos.

For example, in venture capital, if you don’t have 20 years of experience in finance, you’re often dismissed. But the same applies in tech, policy, and science—if you haven’t been in the field for decades, some people won’t take you seriously.

That elitist mindset holds back progress.

In Europe, this is especially true. There’s still a hesitation to collaborate across disciplines. But this is changing. More investment funds are integrating professionals from different fields, including regulatory experts, public affairs specialists, and strategists.

Because if you’re investing in AI but don’t have AI strategists, regulators, and policy experts on your team, how can you really understand its potential?

Some funds still focus only on finance and engineering, but they’re missing the bigger picture. The bubble will burst eventually, and the funds that embrace interdisciplinary expertise will be the most successful.

The Future of AI as an Investment

How profitable is it to invest in AI as a tool?

Probably for another one to three years at most.

The challenge is that technology evolves rapidly. Sometimes, an AI innovation is developed in one region but applied in another region that isn’t as advanced. That creates short-term investment opportunities.

But by 2030, the entire investment landscape will be completely different. And in investment terms, five years isn’t that long.

Evaluating AI Projects: What Makes True Innovation?

As an EU expert evaluating cutting-edge AI projects, what do you look for? How do you separate real innovation from just another application?

We have strict evaluation criteria set by the European Union, depending on regional and national strategies.

But beyond the formal requirements, my focus is on three key questions:

Is this technology truly possible?

Is it already happening?

How does it fit into Europe’s long-term strategy?

In the past, evaluation was more about assessing what we already had. Now, we must look outward and ask: How does this AI technology fit into the global landscape?

AI and Cybersecurity: A Critical Intersection

Earlier, you mentioned that no one is intentionally designing AI to be harmful. But do you think humans would still develop something that could harm us?

Yes. Unfortunately, humans have a history of doing just that.

How developed is cybersecurity in relation to AI? Can it keep up with the risks AI presents?

Cybersecurity is one of the most complex challenges in AI development. It’s not just about data breaches anymore. It’s about real-time surveillance, satellite tracking, and AI-driven intelligence.

For example, cybersecurity experts can now map an entire region’s vulnerabilities just from digital signals. It’s no longer just about passwords and firewalls—it’s about geopolitics, infrastructure, and global security. And remember: anything that can read can also write. If an AI system can read data from a region, it also has the potential to alter data in that region. This is the reality of cybersecurity today.

Investment Strategy: Climate Tech, Transportation, and Infrastructure

Your fund focuses on climate tech, transportation, and infrastructure. How do you define your investment strategy?

For us, climate tech means investing in technologies that accelerate the energy transition. For example, we have innovations that can eliminate the need for fossil fuels—not just for sustainability reasons, but simply because they’re more efficient and cost-effective.

We also invest in next-generation transportation, including a major project in train transport that we’re close to closing. At SIGF, we don’t just invest passively—we actively support the companies we invest in. We connect the dots between regions, technologies, and stakeholders to make sure these innovations succeed.

So all of your portfolio companies integrate AI?

Yes, they have to. AI is a fundamental component of every project we back. But we also focus on hybrid technology—ensuring that our investments are both useful today and adaptable to future advancements.